How Many Bank Accounts Should You Have When You Run a Business?

Find out how many bank accounts a business owner should have for business finances.

When you’re running a business, keeping track of your money is anything but straight forward.

It’s common for business owners to begin by using a single bank account for everything, but this can create a big old mess down the track.

Why?

No clear separation: With one account, it’s hard to distinguish between personal and business expenses, making it tricky to track your business's actual performance and health. You might end up mixing in personal purchases with business expenses, which can get confusing fast.

Tax time headaches: Sorting out what’s deductible and what’s not becomes a nightmare. With everything in one account, you (or your bookkeeper) will have to sift through transactions line by line, trying to pick out what’s relevant for taxes—making the process time-consuming and error-prone.

Cash flow confusion: Without separate accounts, it’s hard to see how much cash is really available for expenses, taxes, and profit. You might overspend on personal or business expenses without realizing that it’s putting you in the red.

Profit and budgeting issues: Keeping profits, taxes, and operating expenses all in one place means you’re less likely to set aside funds for each purpose. This can lead to overspending and a lack of cash reserves, making it challenging to budget effectively and putting unnecessary stress on your cash flow.

Setting up separate accounts for things like operating expenses, taxes, and profit is a simple but powerful way to keep your finances organised and avoid potential pitfalls. It makes it easier to see where your money is going, budget properly, and focus on growth!

Enter the Profit First methodology – a simple way to keep things organised and ensure you’re building sustainable and easy to track business finances.

So, how many business bank accounts should you actually have?

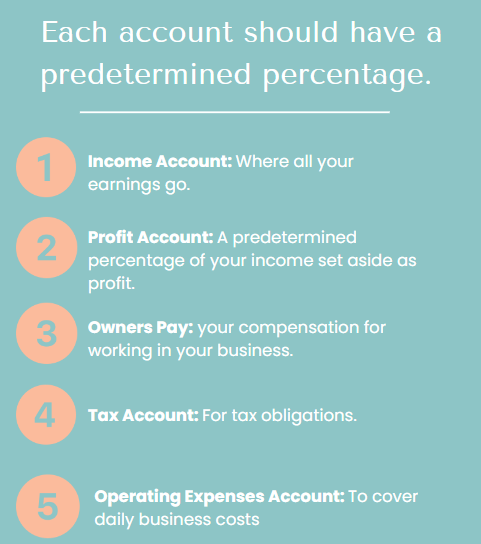

With the Profit First method, it’s recommended that business owners set up at least five main accounts:

Income Account

Think of this as the hub for your for cash flow. Every dollar your business earns goes into this account. From here, you’ll distribute the money into your other accounts according to set percentages. This step helps create clarity – you’ll always know exactly how much money is coming into the business.Profit Account

Here’s where things start to get interesting. Before you pay anything else, you should take a portion of your income and put it into a separate account specifically for profit. This step ensures that your business is profitable from every sale. Even if you’re only setting aside a small percentage, it builds the habit of prioritising profit.Owner’s Pay Account

This is your personal payday. You’re not in business to work for free – so why treat yourself like you are? The Owner’s Pay makes sure you’re getting paid from every sale whether your business is having a good month or a lean one.Tax Account

Tax time doesn’t have to be stressful if you’re putting away a portion of your income every month. With a dedicated tax account, you’ll have the funds ready when it’s time to settle your obligations with the ATO, stopping that last minute BAS or tax scramble scrambling to find the cash.Operating Expenses Account

This account is for your business expenses, we know how those can creep up and for some reason they all seem to hit at once! Whether it’s paying for equipment, insurances, technology and more, having a dedicated account for operating costs helps you manage spending without dipping into your profits or owner’s pay.

Profit First business account recommendations

By organising your finances with these accounts, you’ll always know where your money is going. More importantly, you’re on the way to understanding how to make your business both profitable and sustainable, giving you greater peace of mind and a better chance of succeeding.

Want to chat about this in detail? Get in touch